This month, we met the nutritional supplements, food processing, and beverage production communities at Natural Products Expo West in Anaheim, California.

The expo focused on natural and organic products, including companies across a number of different industries, with the aim of promoting healthier, more sustainable products. We also took the opportunity to meet with Kinnek customers and suppliers. Here's the Kinnek outlook from the Expo:

Natural Products: Sunny with Little Chance of Clouds

The industry has grown from $200B in 2005 to $660B in 2012 and is expected to more than double to $1524B by 2020. Growth is set to continue due to the following factors:

-

Significant interest in heritage ingredients and methods of preparation such as incorporation of ancient grains into foods and the popularity of the paleo diet;

-

Greater emphasis on science-based nutrition such as probiotics and “smart” products with infused proteins;

-

Customer preference for sustainability and fair trade labels over price.

Supplements: Caught in a Storm, but Signs of Sunny Skies Ahead

Supplements: Caught in a Storm, but Signs of Sunny Skies Ahead

Recently, the market for dietary supplements has taken a hit due to New York State Attorney General’s investigations into the alleged improper marketing of companies. While the panel generally found the reasoning behind the investigations questionable, a poll of executives at the Expo showed 61% thought that eroding consumer trust in dietary supplements was the biggest challenge facing the industry.

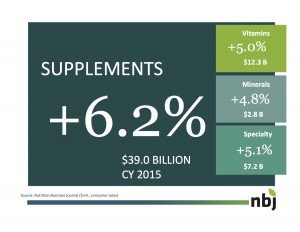

However, the panel expected recent scrutiny to lead to greater transparency and consumer trust in the long-term. In fact, dietary supplements and, more broadly, the supplements industry are expected to see sustained growth through the rest of the decade (according to the Nutrition Business Journal, 6.2% growth from 2014-15, and 5.8% expected annual growth).

However, the panel expected recent scrutiny to lead to greater transparency and consumer trust in the long-term. In fact, dietary supplements and, more broadly, the supplements industry are expected to see sustained growth through the rest of the decade (according to the Nutrition Business Journal, 6.2% growth from 2014-15, and 5.8% expected annual growth).

Organics: A Near Perfect Day

Organics are currently one third of the volume of natural products in the market and there are 19,474 certified organic operations in the US alone. These numbers are only expected to grow. A panel of industry experts discussed some of the consumer trends underlying this growth, which include increased:

-

Retail presence in conventional grocers and large retailers;

-

Awareness/demand for “natural” products due to strong marketing around a more plant-based diet, leading to increasing popularity of plant proteins and vegetable-based innovations (dehydrated and raw snack foods, for example);

-

Consumer knowledge and demand, especially on mobile, where the volume of organic food purchases doubled in 2014;

-

Number of purchasing options, including the emergence of grocery delivery and meal boxes with organic ingredients. Grocery stores are also jumping on this trend and providing more finished organic goods (prepared foods, fresh raw juices, etc).

Organic Advisory: Watch for Sporadic Showers!

While the organic trend is full of upside, certification remains a big hurdle for organic companies, taking a number of months and typically costing several thousand dollars. Jaclyn Bowen from Quality Assurance International identified the best practice as developing an organic system plan and implementing the plan as the first step to mitigating these issues.

However certification in itself shouldn’t be seen as the end of the process, organic companies should be prepared to deal with the ongoing process post-certification too.

Kinnek’s Lessons Learned

Interestingly, while the equipment needed for production of organic products does not differ significantly from conventional production, there are several differences between organic and conventional supply chains.

Kellee James is the founder and CEO of Mercaris, an online trading platform connecting buyers and suppliers of organic commodities. According to James, the key difference in obtaining the certified organically grown ingredients is in the processes themselves.

For example, oil and juice extraction for organic companies involves methods such as low-pressure and cold-pressing, while conventional methods use chemicals like hexane. Other differences include the availability of:

-

Commodity supply (organic products are more limited, with only 2% acreage dedicated to organic produce in the US);

-

Processing plants (the number of conventional facilities far exceed organic facilities that use organic oils);

-

Organic Importers.

Kinnek’s Final Forecast

With a population more and more focused on healthier consumption, the natural and organic markets are poised to see explosive growth. Small to medium sized business in these fields are primed to take advantage of this boom, partiuclarly due to their dedication and passion for these product(s). And with Kinnek providing painless purchasing to SMBs in this industry, you can focus on your business.Not sure what's right for your beverage business? The Kinnek marketplace can help you with that. Subscribe to our blog to get the latest Kinnek news.